March 2022 Newsletter

It's Already March! March. Here we are already. Despite the sadness in the world today and the craziness of the markets, Shon and I are very excited about the growth of our firm. We have begun this year with in person workshops where we have the privilege of meeting new people, shaking real hands, and beginning the process of helping them plan for the future. This is much better than waving hello over a computer screen as we did for the past 2 years in our webinars! Our event calendar is below; take a look! Pass along our information to anyone who might want to attend!

Here is what we are covering in the March newsletter:

- Market Updates – Rearview to Windshield

- What the analysts are saying – Quad update

- This Month’s Spotlight – Darrin McComas

- Tax Documents from TD Ameritrade

- Social Media updates (website, LinkedIn, Facebook, and YouTube)

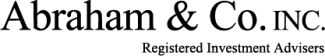

There’s a LOT Going on in the World – Market Updates I don’t know about you, but the older I get, the less I like rollercoasters. When I was a teenager, I loved a good coaster ride. Now, however, they make me sick to my stomach. I have the same feeling with the stock market recently as I would imagine you do too. 2022 is starting out to be a very challenging year. The markets have been very much “news driven” - reacting with wild swings in both directions based on a constant barrage of good news/bad news. Here’s how the markets performed in February:

The good news is that your accounts aren’t down like the major indices (and most hedge funds) are. This is why we are such strong believers in the hybrid approach of Fixed Index Annuities + Actively Managed Portfolios versus cookie-cutter portfolios and the age-old adage of “just ride it out.” Why “ride out” a 40% drawdown if you don’t have to? Did you know if your account goes down 40%, it takes a 67% return just to get back even? That could take over 8 years to get even based on historical stock market performance. Not a fun way to go through retirement.

Most of our clients have some portion of their retirement savings in a Fixed Index Annuity for difficult times just like we are seeing in 2022. Sometimes, zero really is THE hero. While we agree that this saying can be corny, if you are even slightly concerned about market volatility a Fixed Index Annuity is a great product to protect your hard-earned savings and keep up with inflation.

If you would like more information on the stock markets, please click on the link below for our latest Market Update video. We also have prepared a great video on the Power of Compounding Returns that we think you would appreciate as well.

Analysts Updates – What the data is telling us

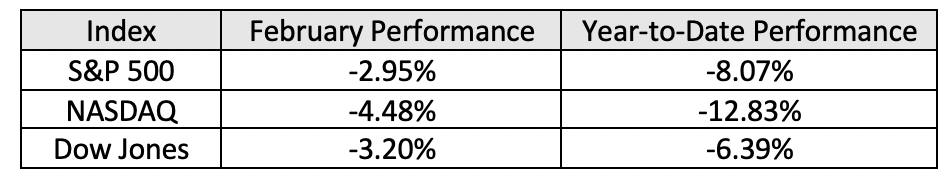

Our analysts at Hedgeye Risk Management keep reiterating that the US markets will be in deep Quad 4 for much of 2022. If you are new to Abraham & Co., Inc., Quad 4 is where stock pickers get hammered. I believe Hedgeye is spot on with their data and analysis. There are a couple main driving factors that are pushing markets deeper and deeper into Quad 4. The main factor being the high price of oil. Of course part of this has to do with the Russia-Ukraine conflict and Russia being kicked off the SWIFT banking system. The higher oil goes, the deeper Quad 4 will be in the coming quarters. Remember, oil is THE BIGGEST factor in real inflation. The price of oil affects everything from food prices to transportation to consumer discretionary. Everything will feel the ripple effect of high oil prices.

If you examine the chart above, you can see that 2022 actually started out in Quad 3 (stagflation) but is quickly pricing in the move to Quad 4 in the second quarter. Quads 3 and 4 are notoriously tough on the markets. Besides the high price of oil driving up inflation, Hedgeye Risk Management is also making the DEEP Quad 4 call based on some of the toughest year-over-year comparisons in the history of the market. Last year at this time, the Fed was pumping over $1.3 trillion into the economy. This ultimately led to some of the sharpest increases in spending in our nation’s history and most stocks ripped upwards as a result. Now, starting in March, we are going to run head-on to those almost impossible year-over-year comparisons. The end result will be most companies won’t beat earnings and will likely revise their forward earnings towards the downside. The markets are already pricing this in, to what extent we do not know.

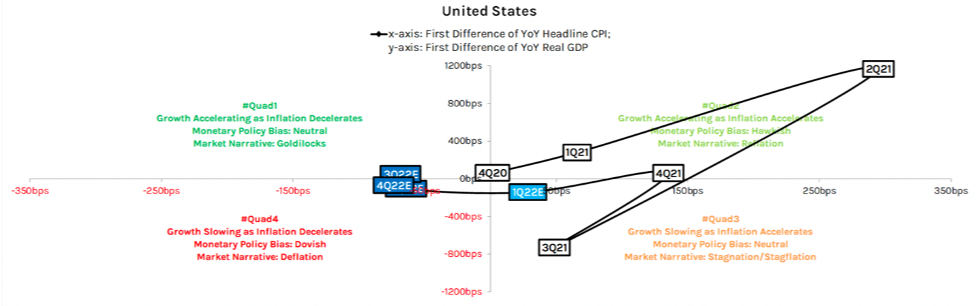

The last major factor that is contributing to the DEEP Quad 4 call is the Fed. With inflation running hot at over 7%, the Fed is backed into a corner. The main weapon against rising inflation is to raise interest rates. Right now, Wall Street is betting on just under 6 rate hikes for 2022 (see image below). We will see if they can pull this many rate hikes off or not. My bet, the Fed only gets 1, maybe 2 rate hikes in before they reverse their course of action. The Fed runs the risk of being too aggressive on raising interest rates and crashing the economy, and thus ultimately the stock markets. It will be interesting to watch them try to “thread the needle” in 2022.

Taxes

Would you like a second opinion on your 2021 taxes before you file them with the IRS? We recently purchased access to an amazing tax planning tool by Holistiplan. With this service, we can immediately identify key income break points for tax planning opportunities like ROTH conversions, tax-efficient withdrawals, charitable giving, and much more. We are offering this service to ALL of our clients 100% FREE OF CHARGE. Before you submit your return to the IRS, feel free to email us a PDF copy of your return and we will run it through Holistiplan’s software and send you a FREE report that will highlight possible missing deductions as well as opportunities to do some tax minimization planning for 2022.

Client Referral Program

Our referral program is still taking place! Turn in those names of any friend or family member that might need a 2nd opinion, a fresh perspective on protecting their money during these times! Email me at dmccomas@abrahamco.com. Each person that refers someone will have their name placed in a drawing 2 times! We draw names at the end of each month!

Thank You For Trusting Us While 2022 is off to a rough start, we can’t stress to you enough that we are staying vigilant when it comes to protecting and growing your hard-earned money. Even with all the craziness in the world, we feel confident that whatever the markets throw at us, we will persevere and come out on top. As always, if you have any questions or concerns, please don’t hesitate reaching out to us. Thanks so much and God bless. Darrin McComas Investment Advisor Representative