April 2022 Newsletter

Spring is here! And Easter weekend is only a few days away! We hope you have big plans of spending the day with your family and friends, and celebrating the beginning of a new season and all the wonderful blessings in our lives!

Here is what we are covering in the April newsletter:

- Market Updates

- What the analysts are saying – Quad update

- Poll Question of the Month

- Very Interesting

- Social Media updates (website, LinkedIn, Facebook, and YouTube)

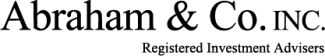

Bear Market Bounce OR is the Bottom Really In? – Market Updates

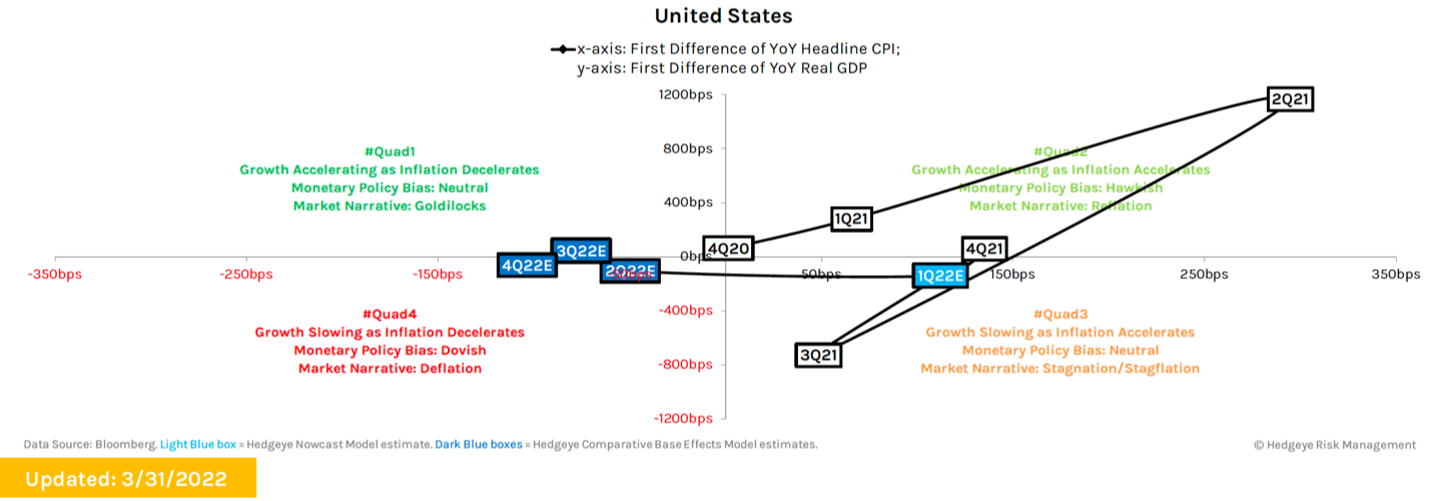

After a big market sell off in January and February, we witnessed a nice bounce in equity markets in March (see chart below). However, don’t let FOMO (Fear of Missing Out) trick you into believing the “bottom is in” or that the bear market is officially over. I believe what we witnessed in March is a typical bear market bounce, ultimately sucking in the last remaining bulls before another plunge downward. Afterall, we are now officially in the 2nd Quarter and our analysts at Hedgeye Risk Management have the probability of a Quad 4 for Q2 at over 74% (that’s as close to a statistical certainty as they come). For our new clients, Quad 4 is where equity markets get wrecked, apart from a few select asset classes. Let’s dig into the numbers…

|

Index |

March Performance |

Year-to-Date Performance |

|

S&P 500 |

5.7% |

-4.88% |

|

NASDAQ |

5.39% |

-9.92% |

|

Dow Jones |

4.58% |

-4.83% |

*Seeking Alpha

Analysts Updates – It’s ALL about the Fed

There is a saying in the financial industry that “the bond market never lies” and the bond market is telling us loud and clear that Quad 4 is coming. For the first time since 2019, the 2-10 (10-year US Treasury minus the 2-year US Treasury) Yield Curve briefly inverted (March 31). Why do we care about Yield Curve Inversion? Inversions are 3 for 3 on preceding large declines in the stock market and 2 for 3 on those declines coming 1-2 quarters thereafter (since 1995). The bond market gets it and the carnage is epic. The Bloomberg Global Aggregate Index is down 7.77% YTD. Not only is this the worst drawdown for a year through early April, it is also surpassing the largest drawdown seen in any complete year.

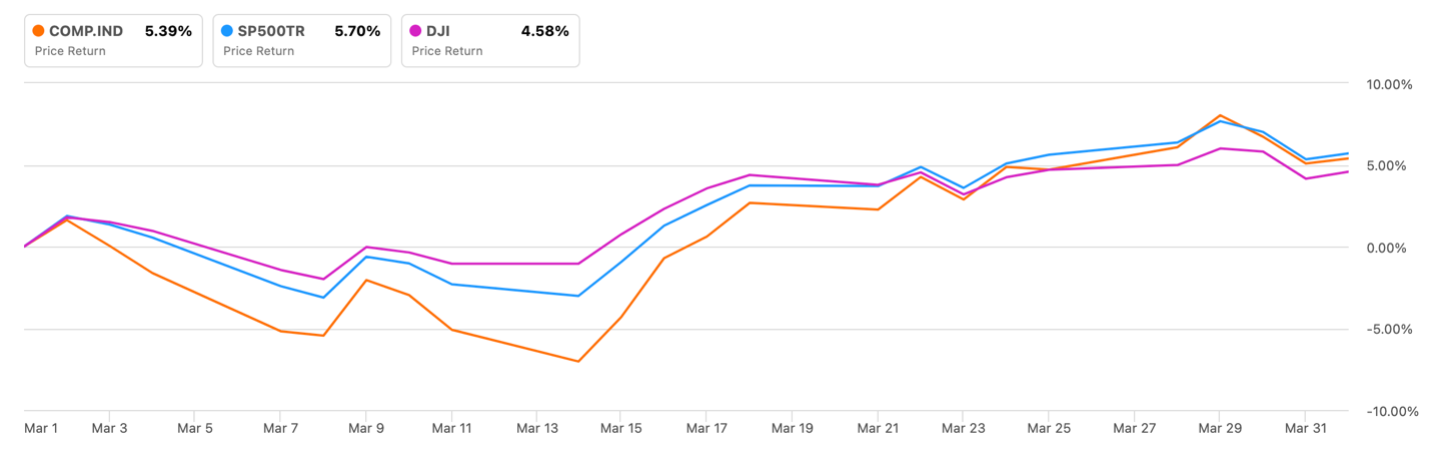

There are a lot in our industry that feel the bond market is doing the job of the Fed. So far, even with inflation running extremely hot, the Fed has managed only one rate hike of 25 bps. The current Wall Street bet is almost 9 additional rate hikes in 2022, almost double from just one month ago. Will the Fed really pull of 9 more hikes this year? It’s never happened in the history of the Fed and our analysts believe the Fed will never be able to pull off that many.

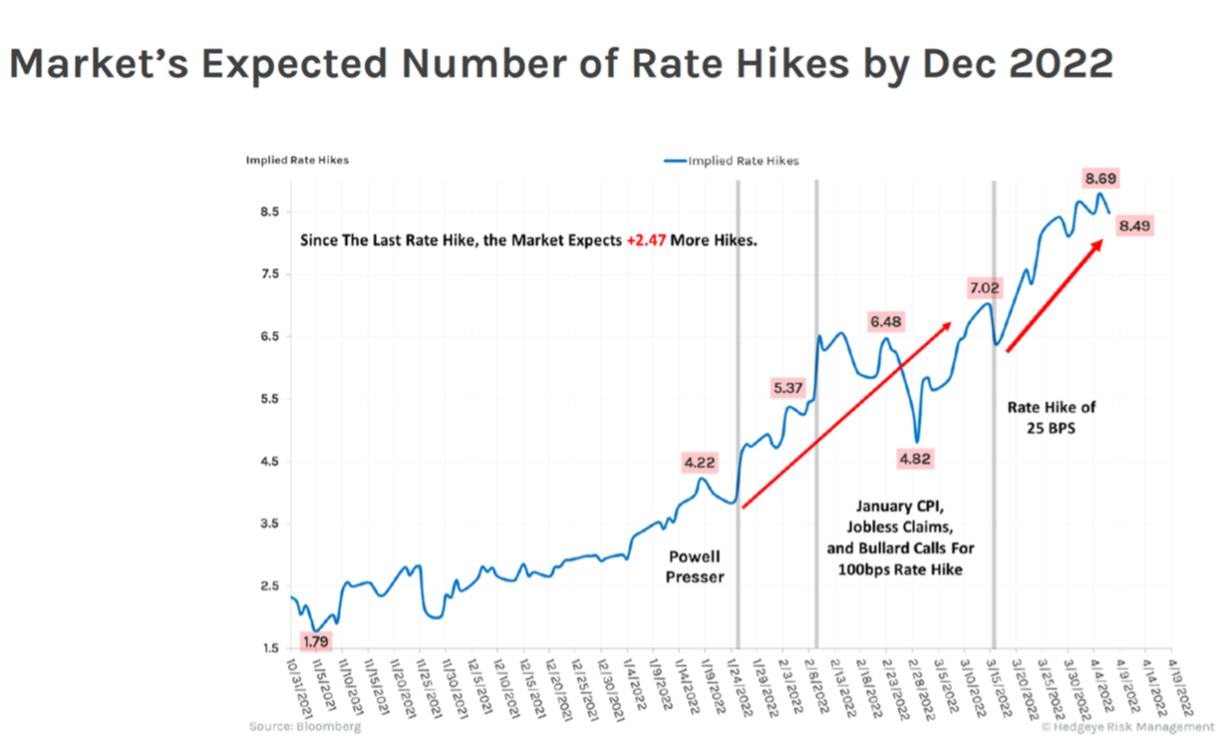

Remember, the Fed has a dual mandate – control inflation and seek full employment. Personally, I believe the Fed has a third, unwritten mandate, and that’s to keep the markets propped up by putting a floor under it via Quantitative Easing (aka The Fed Put). The Fed is looking to reduce its balance sheet by $95 billion a month. In 2018, when the Fed started reducing their balance sheet it ended shortly thereafter when the market dropped by 20%. Don’t forget, we have mid-term elections coming up in November and there will be a tremendous amount of political pressure to fight inflation, keep the economy strong and the markets hitting all-time highs. The Fed has painted themselves into the proverbial corner over the last thirteen years (post Global Financial Crisis). Now, if the Fed raises rates too aggressively, they run the risk of crashing the economy and along with it, the stock AND bond markets. On the other hand, if the Fed continues to slow walk rate hikes, they run the risk of runaway inflation that crushes the average American and ends with the economy imploding. Estimates from Bloomberg Economics show rise in inflation means average U.S. household must spend an extra $5,200 this year ($433/month) compared to last year.

Bloomberg Economics

Best of luck Fed and Jerome Powell as you try to “thread the needle” in the coming months.

There are already signs that cracks are beginning to form:

- Russell 2000 (small caps) teetering on crashing again, down -17.4% from its Cycle Peak.

- NASDAQ drawdown to -13.5% from its Cycle Peak.

- CRB Commodities Index currently at -5.2% from its Cycle High (start of disinflation)

- Oil down -21% from its Peak Cycle Inflation highs.

- Lumber continues to crash (-39.5%) as mortgage rates rocket above 5%

- Numerous other commodities showing early signs of disinflation (inflation slowing)

So, what are some of the tell-tale signs of Quad 4? Here’s a small list of things that are notorious Quad 4 signals:

- Real growth slowing (GDP)

- S. Dollar gaining strength

- Disinflation

Here is the latest Quad Map from Hedgeye Risk Management (X-axis = Inflation / Y-axis = GDP):

© Hedgeye Risk Management, March 31, 2022

What does all this mean for your hard-earned money in those retirement accounts at TD Ameritrade?

We are actively risk-managing your accounts using the forward guidance of Hedgeye Risk Management. Currently our portfolios are positioned in asset classes that typically do well in Quad 4 such as gold, US Dollar, utilities, long/short options-based strategies, and ultra-short duration fixed income. As we brace for Quad 4 in the 2nd Quarter, rest assured your accounts are being watched over with vigilance to avoid major drawdowns. For those of you that monitor your accounts daily, you should be observing that when the markets are down for the day, your portfolio will have fractional losses (and maybe even be green). On the flip side, when the markets bounce upwards, your portfolio will lag behind. We are fine with lagging the markets upward moves because as we move through the 2nd quarter and thus deeper and deeper into Quad 4, we are expecting a lot more market down days than up days. As always, when the signals change, we will pivot accordingly but for now we are sticking with the Quad 4 playbook and playing things very conservatively.

Very Interesting

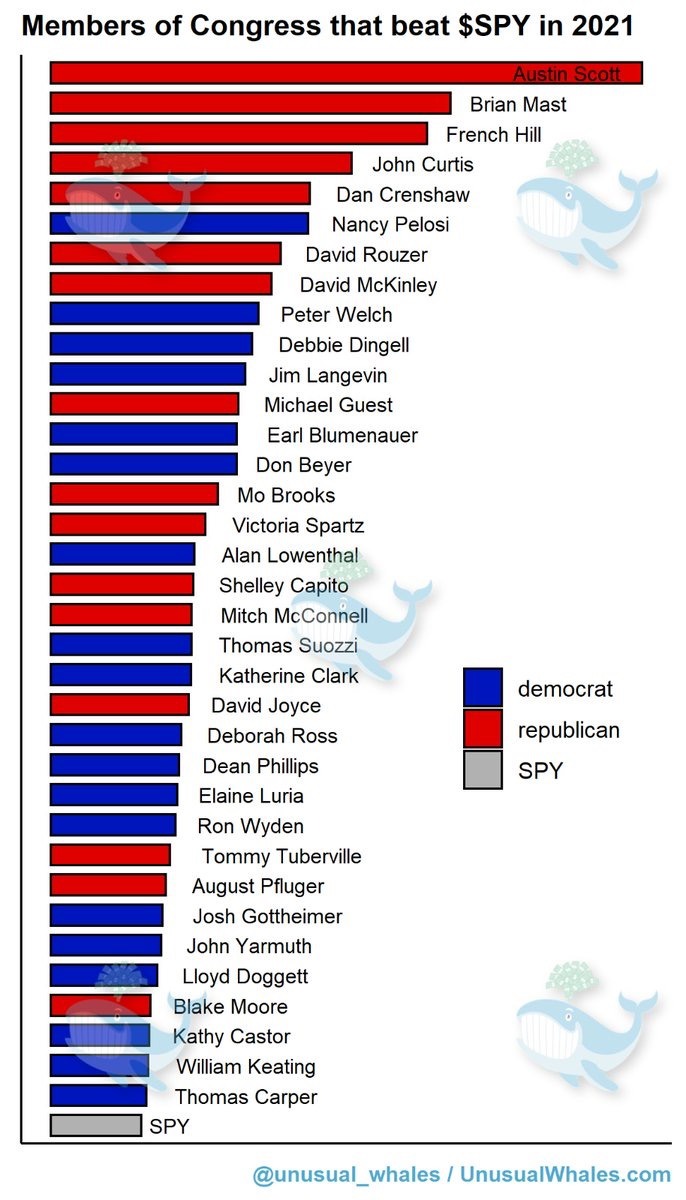

In 2021, only 3 Hedgefunds outperformed the S&P 500. In 2021, 35 politicians did:

Taxes

The last day to file your taxes for 2021 is coming up on Monday, April 18th. Would you like a second opinion on your 2021 taxes before you file them with the IRS? We recently purchased access to an amazing tax planning tool by Holistiplan. With this service, we can immediately identify key income break points for tax planning opportunities like ROTH conversions, tax-efficient withdrawals, charitable giving, and much more. We are offering this service to ALL of our clients 100% FREE OF CHARGE. Before you submit your return to the IRS, contact us for a secure link to upload your 2021 return directly to Abraham & Co., Inc. and we will run it through Holistiplan’s software and send you a FREE report that will highlight possible missing deductions and errors as well as opportunities to do some tax minimization planning for 2022.

Thank You for Trusting Us

One quarter down and three to go. It’s been a bumpy ride in the markets so far, but we’ve weathered the storms well so far. For most of you, tax season is over and many of you took advantage of the historically low tax rates (Trump tax codes) by doing a Roth Conversion in 2021. If no new tax laws are passed, the current codes will sunset at the end of 2025, and we will revert to the Obama era tax codes. For almost every single American, this will mean an automatic increase in your taxation. We will be holding meetings with clients in the next several months to examine if a Roth Conversion is beneficial in your retirement plan. More to come on taxes and Roth Conversions in May’s newsletter. As always, if you have any questions or concerns, please don’t hesitate to reach out to us. Thanks so much and God bless.

Darrin McComas